New rules of real estates in india

Understanding India's New Real Estate Rules: What Home Buyers and Investors Need to Know

India's real estate sector has recently undergone significant regulatory changes aimed at enhancing transparency, protecting consumer rights, and promoting a fair market environment. If you're planning to buy or invest in property in India, it's crucial to stay informed about these new rules to make well-informed decisions. Here’s a breakdown of the key changes and their implications:

1. Real Estate (Regulation and Development) Act, 2016 (RERA): RERA is a landmark legislation that aims to protect the interests of home buyers and promote fair play in the real estate sector. Key provisions include:

-

Mandatory Registration: All new and ongoing real estate projects must be registered with the state's RERA authority. This ensures developers adhere to timelines and quality standards.

-

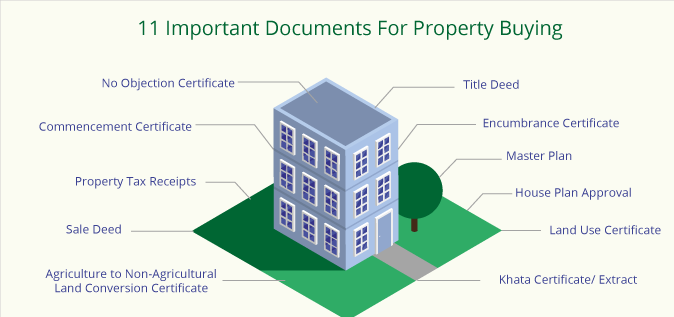

Transparency: Developers must disclose project details such as layout plans, land status, approvals, and timeline commitments. Any changes must be communicated to buyers.

-

Advance Payments: Developers can't ask for more than 10% of the property's cost as an advance without signing a sale agreement.

-

Penalties for Non-Compliance: Failure to comply with RERA can lead to hefty fines or imprisonment, ensuring accountability.

2. Goods and Services Tax (GST):

-

Unified Tax Structure: GST has replaced multiple taxes, such as VAT, Service Tax, and others, simplifying the tax structure for homebuyers.

-

Tax Rates: The tax rate varies based on the type of property (under-construction vs. completed) and other factors. It's essential to understand these rates to budget effectively.

3. Benami Transactions (Prohibition) Amendment Act, 2016:

- Crackdown on Benami Properties: The Act aims to curb the practice of holding property in someone else's name to evade taxes. It includes stringent penalties for offenders.

4. Affordable Housing Initiatives:

-

Priority Sector Status: Affordable housing projects receive benefits such as infrastructure status, tax incentives, and access to institutional funding.

-

Credit-Linked Subsidy Scheme (CLSS): Government schemes like CLSS provide subsidies on home loan interest rates for eligible beneficiaries, making homeownership more accessible.

5. Online Approval Systems and Single Window Clearances:

- Streamlined Approvals: Many states have implemented online platforms for building plan approvals and clearances, reducing bureaucratic delays.

6. Consumer Protection Under Consumer Protection Act, 2019:

- Rights of Homebuyers: The Act enhances consumer rights and provides mechanisms for quick resolution of disputes, promoting trust in the real estate sector.

Implications for Home Buyers and Investors:

-

Empowered Consumers: Buyers now have access to comprehensive project information and legal recourse in case of disputes.

-

Increased Transparency: The era of undisclosed project delays and changes is fading, ensuring more transparent transactions.

-

Market Stability: Regulatory compliance and crackdown on benami transactions contribute to a more stable real estate market.